Joe net worth refers to the total value of an individual named Joe's assets minus their liabilities. It is a measure of an individual's financial wealth. There are many ways to calculate net worth, but the most common method is to add up the value of all of a person's assets, such as cash, investments, real estate, and personal property, and then subtract the total amount of their liabilities, such as debts, loans, and mortgages.

Knowing your net worth is essential for several reasons. It can help you track your financial progress, make informed financial decisions, and plan for the future. It can also be helpful in obtaining loans or other forms of credit.

There are a number of different factors that can affect a person's net worth, including their income, spending habits, and investment decisions. It is important to regularly review your net worth and make adjustments as needed to ensure that you are on track to meet your financial goals.

Joe Net Worth

Joe net worth is a measure of an individual's financial wealth. It is calculated by adding up the value of all of a person's assets, such as cash, investments, real estate, and personal property, and then subtracting the total amount of their liabilities, such as debts, loans, and mortgages.

- Assets: Anything that has value and can be converted into cash.

- Liabilities: Debts and other financial obligations that reduce net worth.

- Income: Money earned from work, investments, or other sources.

- Expenses: Money spent on living expenses, taxes, and other costs.

- Investments: Assets that are expected to increase in value over time.

- Debt: Money owed to creditors.

- Savings: Money set aside for future use.

- Net worth: The difference between assets and liabilities.

- Financial planning: The process of managing money to achieve financial goals.

- Estate planning: The process of planning for the distribution of assets after death.

These key aspects are all interconnected and play an important role in determining a person's net worth. For example, a person with high income and low expenses will likely have a higher net worth than someone with low income and high expenses. Similarly, a person with a lot of assets and few liabilities will have a higher net worth than someone with few assets and a lot of liabilities. By understanding these key aspects, you can take steps to improve your net worth and achieve your financial goals.

Assets

Assets play a crucial role in determining Joe's net worth. Assets are anything that has value and can be converted into cash. This includes both tangible assets, such as real estate, vehicles, and jewelry, and intangible assets, such as stocks, bonds, and intellectual property. The more assets Joe owns, the higher his net worth will be.

- Types of Assets

Assets can be classified into different types, including:- Current assets: These are assets that can be easily converted into cash within one year, such as cash, accounts receivable, and inventory.

- Fixed assets: These are assets that are not easily converted into cash, such as land, buildings, and equipment.

- Intangible assets: These are assets that do not have a physical form, such as patents, trademarks, and copyrights.

- Importance of Assets

Assets are important for several reasons. They can provide a source of income, such as rent from real estate or dividends from stocks. They can also be used as collateral for loans. Additionally, assets can appreciate in value over time, which can increase Joe's net worth. - Managing Assets

It is important to manage assets wisely in order to maximize their value and minimize their risk. This includes diversifying assets across different types and industries, regularly reviewing and updating asset allocation, and taking steps to protect assets from loss or damage.

By understanding the importance of assets and how to manage them effectively, Joe can increase his net worth and achieve his financial goals.

Liabilities

Liabilities are debts and other financial obligations that reduce net worth. They represent the amount of money that Joe owes to others. Common types of liabilities include mortgages, car loans, credit card debt, and personal loans. The more liabilities Joe has, the lower his net worth will be. It is important to manage liabilities wisely in order to minimize their impact on net worth. This includes making regular payments on debts, avoiding unnecessary debt, and consolidating debt when possible.

For example, if Joe has a mortgage of $100,000 and no other liabilities, his net worth will be $100,000 lower than if he had no mortgage. This is because the mortgage is a liability that reduces his net worth. By understanding the importance of managing liabilities, Joe can take steps to reduce his debt and increase his net worth.

In conclusion, liabilities are an important component of net worth. By understanding the connection between liabilities and net worth, Joe can make informed financial decisions that will help him achieve his financial goals.

Income

Income is an important component of net worth. It represents the money that Joe earns from work, investments, or other sources. The more income Joe earns, the higher his net worth will be. There are many different ways to increase income, such as getting a raise at work, starting a side hustle, or investing in income-generating assets.

For example, if Joe earns $100,000 per year from his job and has no other sources of income, his net worth will increase by $100,000 per year, assuming he does not spend any of his income. This is because income is added to net worth.

However, it is important to note that income is not the only factor that affects net worth. Expenses, such as housing costs, food, and transportation, can also reduce net worth. Therefore, it is important to manage expenses wisely in order to maximize the impact of income on net worth.

By understanding the connection between income and net worth, Joe can make informed financial decisions that will help him achieve his financial goals.

Expenses

Expenses are a crucial component of net worth. They represent the money that Joe spends on living expenses, taxes, and other costs. The more expenses Joe has, the lower his net worth will be. There are many different types of expenses, including housing costs, food, transportation, and entertainment. It is important to manage expenses wisely in order to maximize net worth.

For example, if Joe has monthly expenses of $5,000 and no other changes to his financial situation, his net worth will decrease by $5,000 per month. This is because expenses are subtracted from net worth.

There are many ways to reduce expenses. One way is to track expenses to see where money is being spent. Another way is to cut unnecessary expenses. For example, Joe could reduce his expenses by eating out less often or by switching to a cheaper cell phone plan.

By understanding the connection between expenses and net worth, Joe can make informed financial decisions that will help him achieve his financial goals.

In conclusion, expenses are an important component of net worth. By understanding the connection between expenses and net worth, Joe can take steps to reduce his expenses and increase his net worth.

Investments

Investments play a crucial role in building Joe's net worth. Investments are assets that are expected to increase in value over time. This includes assets such as stocks, bonds, real estate, and precious metals. When the value of Joe's investments increases, his net worth also increases.

- Types of Investments

There are many different types of investments, each with its own risk and return profile. Some common types of investments include:- Stocks: Stocks represent ownership in a company. When the company does well, the value of the stock may increase.

- Bonds: Bonds are loans that investors make to companies or governments. When the loan is repaid, the investor receives the principal plus interest.

- Real estate: Real estate is land and the buildings on it. When the value of real estate increases, the investor's net worth also increases.

- Precious metals: Precious metals, such as gold and silver, are often seen as a safe haven asset. When the economy is uncertain, investors often flock to precious metals, which can drive up their prices.

- Importance of Investments

Investments are important for several reasons. They can provide a source of income, such as dividends from stocks or rent from real estate. They can also help Joe grow his net worth over time. Additionally, investments can help Joe diversify his portfolio, which can reduce his overall risk. - Managing Investments

It is important to manage investments wisely in order to maximize their value and minimize their risk. This includes diversifying investments across different types of assets and industries, regularly reviewing and updating investment allocation, and taking steps to protect investments from loss or damage.

By understanding the importance of investments and how to manage them effectively, Joe can increase his net worth and achieve his financial goals.

Debt

Debt is a significant factor that can affect Joe's net worth. Debt represents the amount of money that Joe owes to creditors, such as banks, credit card companies, and other lenders. The more debt Joe has, the lower his net worth will be.

- Types of Debt

There are many different types of debt, including:- Secured debt: Secured debt is backed by collateral, such as a house or a car. If Joe fails to repay a secured debt, the creditor can seize the collateral.

- Unsecured debt: Unsecured debt is not backed by collateral. If Joe fails to repay an unsecured debt, the creditor can take legal action to collect the debt.

- Impact of Debt on Net Worth

Debt can have a significant impact on Joe's net worth. When Joe takes on debt, he is essentially reducing his net worth. This is because debt is a liability, which is subtracted from assets to calculate net worth. - Managing Debt

It is important to manage debt wisely in order to minimize its impact on net worth. This includes making regular payments on debts, avoiding unnecessary debt, and consolidating debt when possible. By managing debt effectively, Joe can improve his net worth and achieve his financial goals.

In conclusion, debt is a significant factor that can affect Joe's net worth. By understanding the different types of debt and how to manage debt effectively, Joe can make informed financial decisions that will help him achieve his financial goals.

Savings

Savings play a crucial role in building and maintaining Joe's net worth. Savings represent the portion of Joe's income that he does not spend and instead sets aside for future use. Savings can be used to cover unexpected expenses, invest for the future, or fund major purchases. The more savings Joe has, the higher his net worth will be.

There are many benefits to saving money. Savings can provide peace of mind, knowing that you have a financial cushion to fall back on. Savings can also help you reach your financial goals faster, such as buying a house or retiring early. Additionally, savings can earn interest over time, which can further increase Joe's net worth.

There are many ways to save money. One way is to create a budget and track your expenses. This will help you identify areas where you can cut back and save more money. Another way to save money is to automate your savings. This can be done by setting up a regular transfer from your checking account to a savings account.

By understanding the connection between savings and net worth, Joe can make informed financial decisions that will help him achieve his financial goals.

Net worth

Net worth is a crucial component of "joe net worth" as it represents the overall financial health of an individual named Joe. It is calculated by subtracting liabilities from assets. Assets are anything that has value and can be converted into cash, such as property, investments, and savings. Liabilities, on the other hand, are debts and other financial obligations that reduce net worth. The higher the net worth, the better Joe's financial position.

For instance, if Joe has assets worth $1 million and liabilities of $200,000, his net worth would be $800,000. This means that Joe has more assets than liabilities, indicating a strong financial position. Conversely, if Joe's liabilities exceed his assets, he would have a negative net worth, which is a sign of financial distress.

Understanding the connection between net worth and "joe net worth" is essential for several reasons. Firstly, it provides a clear picture of an individual's financial well-being. Secondly, it helps in making informed financial decisions, such as determining how much debt to take on or how much to invest. Thirdly, it serves as a benchmark against which to track financial progress over time.

In conclusion, "joe net worth" is heavily influenced by the net worth of an individual. By understanding the relationship between assets and liabilities, Joe can make informed financial decisions that will positively impact his overall financial health.

Financial planning

Financial planning is an essential component of "joe net worth" as it provides a structured approach to managing money and achieving long-term financial objectives. Through careful planning, individuals can optimize their financial resources, reduce risks, and build a strong foundation for their financial future. Without proper financial planning, it becomes challenging to make informed decisions and effectively manage "joe net worth."

A well-defined financial plan outlines strategies for income management, budgeting, savings, investment, and retirement planning. By adhering to a comprehensive plan, individuals can align their financial decisions with their goals and priorities. This proactive approach helps maximize returns on investments, minimize unnecessary expenses, and mitigate financial risks that could potentially impact "joe net worth."

For instance, if Joe has a clear financial plan that prioritizes saving and investing, he can consistently allocate a portion of his income towards these goals. By regularly monitoring his financial progress and making adjustments as needed, Joe can stay on track to accumulate wealth and grow his "joe net worth" over time. Conversely, an absence of financial planning could lead to impulsive spending, excessive debt, and missed opportunities for building wealth.

In conclusion, understanding the connection between financial planning and "joe net worth" is crucial for building a secure and prosperous financial future. By embracing a proactive approach to managing money and following a well-structured financial plan, individuals can make informed decisions, optimize their financial resources, and ultimately enhance their "joe net worth." Neglecting financial planning can lead to missed opportunities, financial setbacks, and potential risks that could compromise long-term financial goals.

Estate planning

Estate planning plays a significant role in "joe net worth" by ensuring the orderly distribution of an individual's assets after their passing. It involves creating a comprehensive plan that outlines how assets will be managed and distributed to beneficiaries upon the individual's demise. This connection is crucial because it provides a clear roadmap for the preservation and transfer of wealth, ensuring that "joe net worth" is managed according to the individual's wishes and objectives.

Effective estate planning helps maximize the value of "joe net worth" by minimizing taxes, avoiding probate costs, and ensuring that assets are distributed according to the individual's intentions. A well-structured estate plan can reduce the financial burden on beneficiaries and streamline the distribution process, preserving the integrity of "joe net worth" for future generations.

For instance, if Joe has a substantial "joe net worth" but fails to create an estate plan, his assets could be subject to the laws of intestacy, which may not align with his wishes. This could result in unnecessary legal fees, disputes among beneficiaries, and potential loss of assets. By implementing an estate plan, Joe can ensure that his assets are distributed according to his specific instructions, protecting the value of his "joe net worth" and fulfilling his legacy.

In conclusion, understanding the connection between estate planning and "joe net worth" is crucial for individuals seeking to preserve and manage their wealth effectively. Estate planning provides a framework for the orderly distribution of assets, minimizing potential risks and ensuring that "joe net worth" is utilized according to the individual's wishes. Neglecting estate planning can lead to unforeseen consequences, jeopardizing the preservation of "joe net worth" and the financial well-being of beneficiaries.

FAQs

This section addresses frequently asked questions (FAQs) related to "joe net worth" to provide a comprehensive understanding of the topic. These questions aim to clarify common concerns and misconceptions, offering informative answers based on reliable sources and expert insights.

Question 1: What is "joe net worth" and how is it calculated?"Joe net worth" refers to the total value of an individual named Joe's assets minus their liabilities. Assets include cash, investments, real estate, and personal property, while liabilities encompass debts, loans, and mortgages. Calculating net worth involves adding up the value of all assets and subtracting the total amount of liabilities.Question 2: Why is it important to track net worth?

Tracking net worth is crucial for several reasons. It provides a snapshot of an individual's financial health, helps make informed financial decisions, and enables individuals to plan for the future. Monitoring net worth allows for timely adjustments to spending habits, investment strategies, and financial goals.Question 3: What factors can affect net worth?

Numerous factors can influence net worth, including income, expenses, investment performance, and debt levels. Changes in any of these factors can impact an individual's overall financial position. It's important to regularly review and adjust financial strategies based on these evolving factors.Question 4: How can I increase my net worth?

Increasing net worth involves a combination of strategies. Some effective approaches include increasing income through career advancement or side hustles, reducing expenses by budgeting and cutting unnecessary spending, investing wisely to grow assets, and managing debt effectively to minimize liabilities.Question 5: What are the benefits of having a high net worth?

A high net worth offers several advantages. It provides financial security, increases borrowing capacity, and allows for greater investment opportunities. Additionally, a substantial net worth can contribute to a comfortable retirement and financial independence.Question 6: How can I protect and preserve my net worth?

Protecting and preserving net worth requires prudent financial management. This includes diversifying investments to mitigate risks, regularly reviewing insurance coverage, and implementing estate planning strategies to ensure the orderly distribution of assets after death.

In conclusion, understanding "joe net worth" and its various aspects is essential for effective financial management. By addressing common questions and concerns, this FAQ section provides valuable insights into building, maintaining, and preserving wealth. Remember to consult with financial experts or advisors for personalized guidance tailored to your specific circumstances.

Transition to the next article section: Exploring the intricacies of "joe net worth" further, the following section delves into strategies for maximizing net worth and achieving long-term financial success.

Tips to Maximize "Joe Net Worth"

Optimizing "joe net worth" requires a multifaceted approach that encompasses prudent financial management, wise investment decisions, and effective wealth preservation strategies. Here are five essential tips to help individuals maximize their net worth and achieve long-term financial success:

Tip 1: Cultivate Income StreamsDiversifying income sources is crucial for building and maintaining a robust net worth. Explore additional revenue streams beyond traditional employment, such as starting a side hustle, investing in rental properties, or pursuing entrepreneurial ventures.Tip 2: Control Expenses

Effective expense management is paramount in preserving and growing net worth. Track expenses meticulously, identify areas for potential savings, and implement strategies to reduce unnecessary expenditures. Consider negotiating lower bills, optimizing subscriptions, and employing cost-cutting techniques.Tip 3: Invest Wisely

Investing prudently is a cornerstone of net worth maximization. Conduct thorough research, diversify investments across different asset classes, and consider seeking professional financial advice to optimize returns. Remember to evaluate risk tolerance and align investments with long-term financial goals.Tip 4: Manage Debt Effectively

Debt can significantly impact net worth. Prioritize high-interest debts and develop a plan to pay them off efficiently. Consider debt consolidation or refinancing options to secure lower interest rates, thereby reducing the overall cost of debt and improving net worth.Tip 5: Plan for the Future

Estate planning is essential for preserving and distributing net worth according to an individual's wishes. Create a comprehensive estate plan that includes a will, trusts, and other legal documents to ensure the orderly transfer of assets and minimize potential tax implications.

In conclusion, maximizing "joe net worth" requires a combination of proactive financial strategies, informed decision-making, and long-term planning. By implementing these tips, individuals can enhance their financial well-being, secure their financial future, and build a substantial net worth that supports their aspirations and goals.

Conclusion

In the exploration of "joe net worth," we have delved into its components, its significance, and strategies for its maximization. Understanding net worth empowers individuals to take control of their financial well-being and plan for a secure future. By carefully managing assets and liabilities, making informed investment decisions, and implementing effective financial strategies, individuals can build and preserve their wealth, achieving long-term financial success.

The journey to net worth optimization is an ongoing process that requires discipline, planning, and a commitment to financial literacy. By embracing the principles outlined in this article, individuals can harness the power of "joe net worth" to achieve their financial goals and live a life of financial freedom and fulfillment.

Unveiling The Captivating World Of Joseph Simmons Jr. On Television

Unlocking "Joe Net Worth": Unveiling Secrets And Strategies For Financial Success

Unveiling The Secrets Of Kimora Lee Simmons' Towering Presence: A Journey Into Height And Success

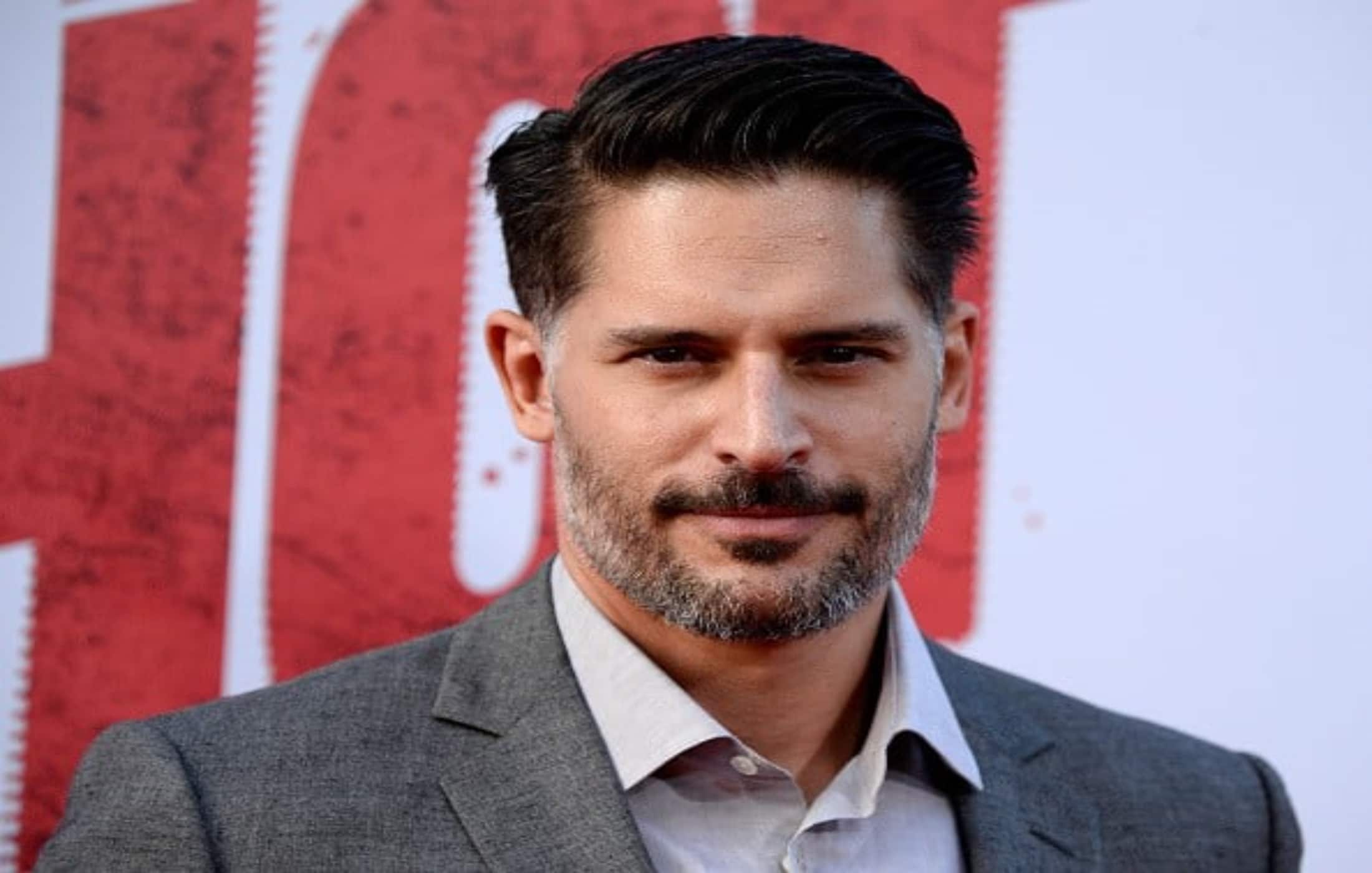

Joe Manganiello net worth, age, wiki, family, biography and latest

Joe Alwyn's Net Worth In 2022 How Rich Is Taylor Swift Boyfriend!

ncG1vNJzZmiglaLBpr6NmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cLbOnmSnnaRixLC%2B06FloaydoQ%3D%3D